India’s Best e-Invoice Software to Simplify Your GST e-Invoicing

Why only Indian ERP Software for E-Invoicing?

Generate E-Invoice without going to Portal

7 Years Cloud Backup

Print QR code & IRN on Invoice

Validate Party GSTIN on Single Click

Digital Signature on Invoice

Auto-error Correction

GSTR 2A/2B Online Reconciliation

Zero Downtime

Online E-Way Bill

Start your free trial!

Empowering Businesses, Enabling Better India Through IT

All about Indian ERP e-invoicing Software

Electronic Invoice, also known as e-Invoice in India, is a method of creating e-invoices using an e-invoicing GST software that enables invoices created through one software program to be accessible by other invoice software. When it comes to selecting the best e-invoice softwareIndia, our comprehensive solution stands out. Our e-invoice software is specifically designed to streamline the invoicing process, offering a seamless experience for businesses. With Indian Erp GST e-invoice software, you can generate invoices electronically, eliminating the need for manual data entry. The software ensures that invoices are created using a standardized format, enabling easy sharing of electronic data and maintaining consistency in information across platforms. Say no to time-consuming manual tasks and embrace the efficiency of our software for e invoice under GST

Why Indian ERP is the best e-invoice software in India?

Advance Features to make your e-invoicing process simple & smooth

Upload e-Invoice directly

Directly upload multiple invoices to IRP (Invoice Registration Portal) through GSTN portal without visiting any other sources & instantly file GST returns using Indian invoicing software

Eway Bill Generation

Generate & directly upload Single/ Bulk E-way bill with JSON File on the portal & reconcile automatically .

Advance Data Validation

Best software for e-invoice under GSTautomatically validates your data to identify errors, violations, incorrect entries & missing mandatory fields to ensure 100% compliance of legal accuracy

Generation of QR Code

Generate QR Code to provide information about a particular invoice in a quick manner, without retrieving from any external sources

Auto- Reconciliation

Upload B2B transaction invoices on GSTN portal electronically & the details will get auto-populated in GST ANX-1 and GST ANX-2

Track e-Invoices

Generate, print and track e-Invoicing in real-time as per the proposed format. Get end-to-end assistance for filing GST returns

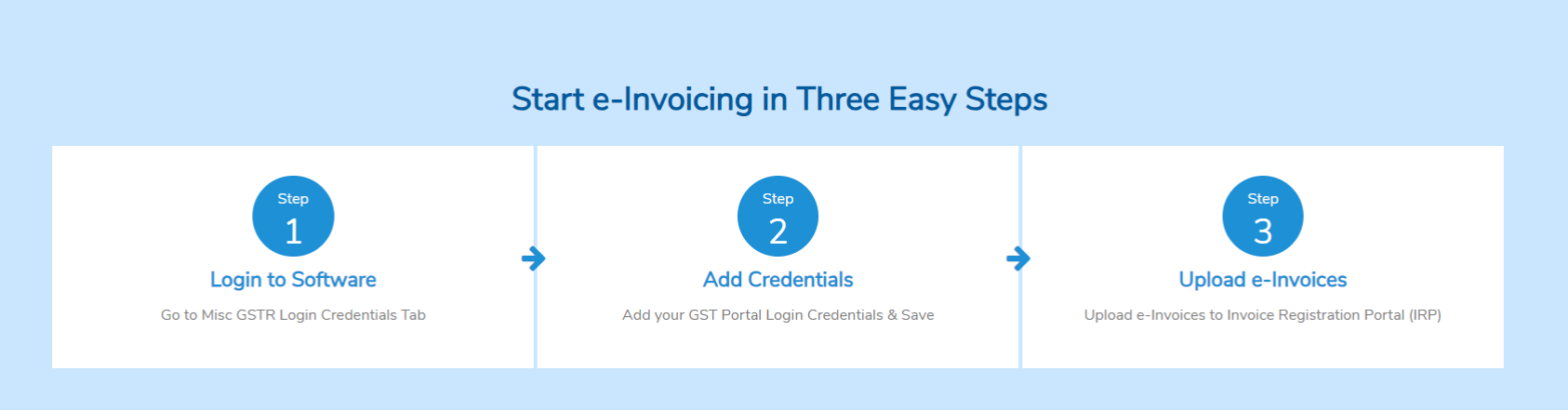

How to Generate E-Invoice in Indian ERP?

The main reason behind adopting the e-invoicing solutions is to pre-populate the returns and eliminate the reconciliation errors. In result, the continuous uploading of invoices ensures the most of the details required in returns as well in the e-way bill get auto-populated. To streamline the entire e-invoicing process, you must implement e invoicing solutions in your business. Watch the below videos to know the complete implementation process on the best e-invoicing software – Indian ERP.

Benefits of e-invoicing for Indian businesses

Creating and sending electronic invoices is quick and simple with India Comp Tech. Creating e-invoices takes a few clicks. This not only helps save time but also offers the possibility of receiving payment from clients more quickly when it is shared to them. The buyer doesn’t have to keep reminding the customer to pay.

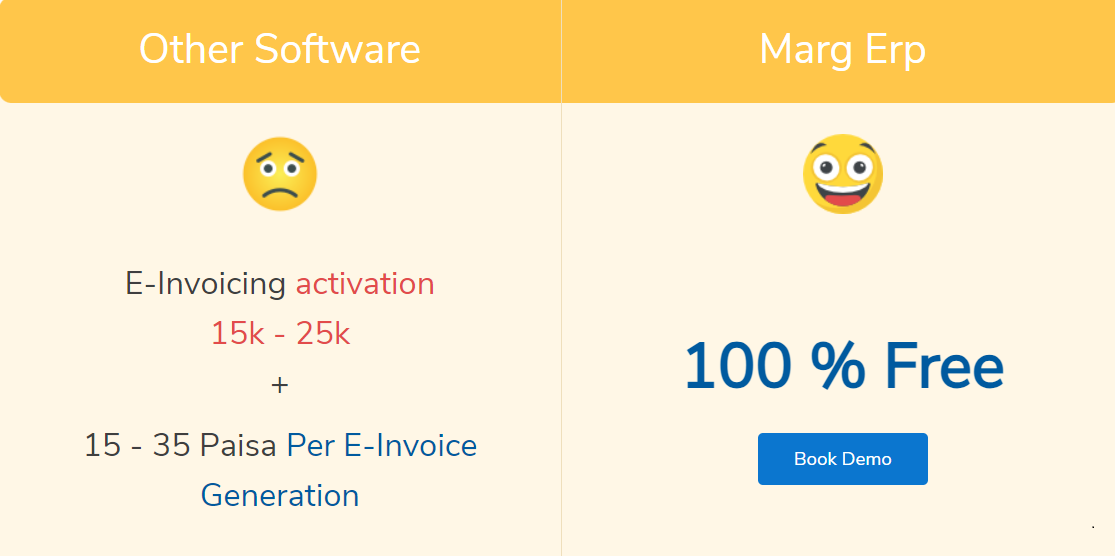

Unlike other electronic invoicing systems available in the market, Indian e-invoice software India is extremely cost-efficient. Specially designed for small & medium-sized businesses, Indian ERP doesn’t charge any extra charges for GST portal or anything. Indian ERP provides 100% free e-invoice generation.

Indian e-invoicing software allows the tracking of invoices in real-time prepared by the supplier on Indian ERP 9+. This permits the faster availability of input tax credit (ITC).

With the best software for e invoice under GST, the chances of errors and mistakes decreases resulting in the reduction of tax evasion and elimination of fake invoices.

Better Customer Service. Apart from the basic e-invoicing benefits, Indian electronic invoicing software offers better customer service with handholding training & real-time assistance in the generation of e-invoices.